Seamless Transitions: Your Ultimate Guide to Transferring UK Pensions to India

Transferring your UK pension to India can seem like a daunting task, but it doesn't have to be. With the right information and guidance, you can navigate the process smoothly and take advantage of the benefits that come with it. Many expatriates find themselves in a situation where they need to manage their retirement funds across borders, and understanding how to transfer your pension effectively is crucial for securing your financial future.

In this guide, we will explore the essential tips for successfully transferring a UK pension to India. Whether you are moving back home after years abroad or simply looking to manage your pension from a different country, our aim is to provide you with valuable insights and practical steps to make the transition as seamless as possible. With uk pension transfer to india of the process, you can ensure that your hard-earned funds are in the right place, ready to support you in your retirement years.

Understanding UK Pensions

UK pensions encompass various retirement savings schemes designed to provide financial security to individuals after they retire. These schemes can include the State Pension, workplace pensions, and personal pensions. Each type has different rules regarding contributions, payouts, and tax implications, making it essential for individuals to comprehend their specific circumstances and options available.

When considering a UK pension transfer to India, individuals must first understand the key aspects of their pension scheme. This includes factors such as the type of pension plan, the accumulated value, and the potential benefits of transferring to an Indian pension scheme. Understanding these elements will aid in making informed decisions and optimizing financial outcomes.

It is also important to consider the implications of currency fluctuations and tax regulations associated with transferring pension funds internationally. Consulting financial advisors or pension transfer specialists can provide valuable insights into the process, ensuring a smoother transition and helping to avoid potential pitfalls along the way.

The Transfer Process to India

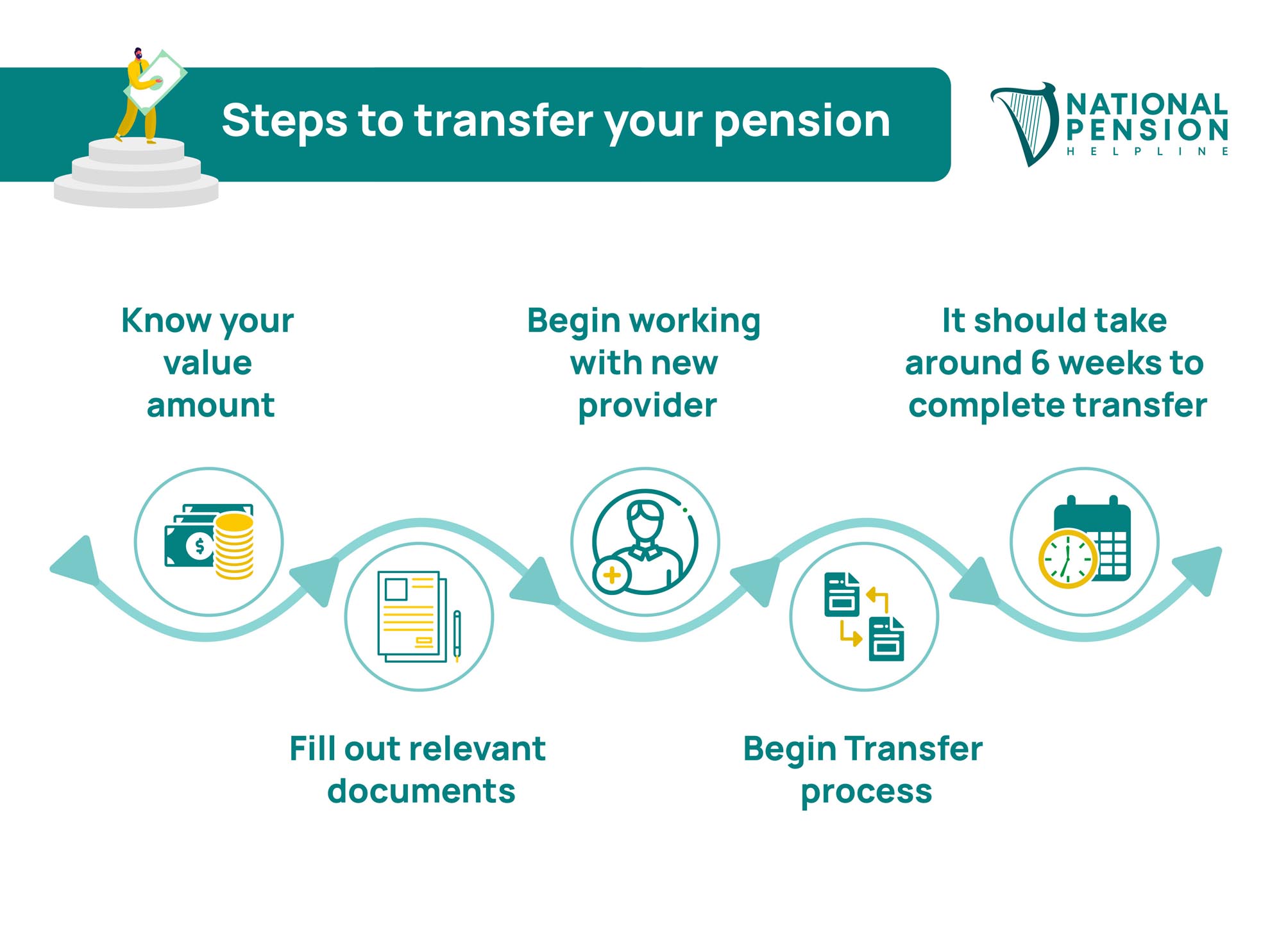

Transferring your UK pension to India involves several crucial steps that require careful planning and understanding of both countries' regulations. The first step is to review the specifics of your UK pension scheme, as not all pensions are eligible for transfer. It is essential to consult with your pension provider to understand your options and the potential impact on your retirement income. Gathering all relevant information will streamline the transfer process and help you make informed decisions.

Once you confirm your eligibility for transfer, the next step is to engage a financial advisor experienced in international pension transfers. They will help you navigate the complexities of both UK and Indian tax laws, ensuring you are fully aware of any tax implications. Additionally, they can assist in selecting the right type of Indian pension scheme for your needs. Professional guidance can significantly reduce the risk of complications during the transfer.

After selecting a suitable Indian pension scheme, you will need to initiate the transfer process with your UK pension provider. This typically involves completing necessary forms and providing documentation to facilitate the transfer. The timeline for completing the transfer can vary, but it is essential to stay in touch with your financial advisor and pension provider throughout the process to ensure everything proceeds smoothly. By following these steps, you can achieve a successful transfer of your UK pension to India.

Tax Implications and Considerations

When transferring your UK pension to India, it's crucial to understand the tax implications that may arise. In the UK, pension withdrawals can be subject to income tax, which will depend on your personal allowance and the amount you choose to withdraw. If you are planning to access your pension before the age of 55, there may be additional tax penalties. It is wise to consult with a tax advisor in the UK to clarify your liability before making any decisions.

Once you transfer your pension funds to India, you may also encounter tax obligations at home. India taxes income from foreign sources, including pension income. However, the tax treatment can vary based on whether the pension is classified as an annuity, lump sum withdrawal, or other types. Familiarize yourself with the provisions of the Double Taxation Avoidance Agreement between the UK and India, as it could help minimize your overall tax burden.

Additionally, the timing of your transfer can influence your tax liabilities. Consider the fiscal year in both countries and how your transfer will impact your taxable income. Engaging a tax professional with expertise in international pensions will help ensure compliance and optimize your financial outcome during this transition.